Originally published on March 19, 2024, updated February 25, 2025

Menu

Join Our Email List

- Receive our monthly newsletter.

- Stay up to date on Amazon policies.

- Get tips to grow your business.

The wholesaler cash conversion cycle can be tricky to navigate. In this guest post, our partners at Viably explain how to align your funding with the cycle.

Thanks to rapid growth in the eCommerce field in recent years, the days when Amazon sellers struggled to find funding for their businesses are long gone. As individual Amazon businesses have become more and more lucrative and unique selling strategies have appeared, avenues for supplementary and alternative funding have expanded.

However, not all eCommerce funding solutions are created equally. And, at the same time, each Amazon selling strategy faces a unique set of working capital challenges that need to be addressed with funding–meaning they need specialized solutions.

Amazon wholesale is the second largest sales strategy on the eCommerce giant’s marketplace, with over a quarter of sellers adopting these practices as a portion of their revenue. Despite this, Amazon wholesalers have been largely overlooked in terms of specialized funding and have historically faced challenges in finding a sustainable working capital solution that meets their needs. In this article, we’ll review what makes Amazon wholesaler funding requirements unique along with providing a brief overview of the options available today.

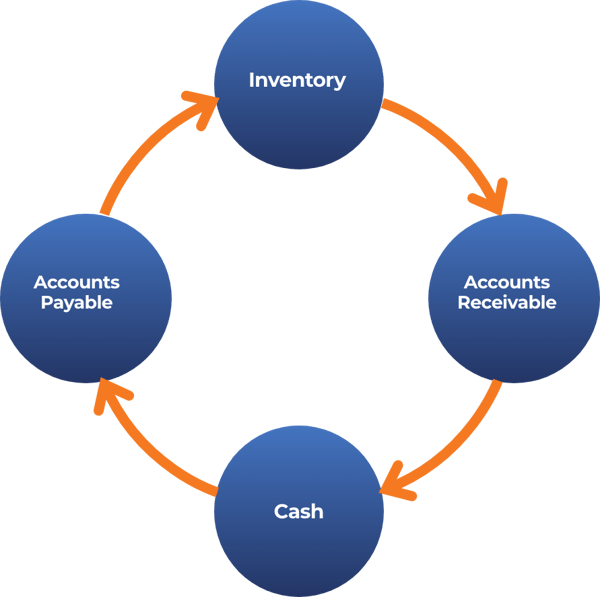

As an Amazon wholesaler, you’re constantly asking yourself: how quickly and efficiently can I turn inventory back into cash through sales? It’s a good question, and the answer will define how quickly you can grow your business making it crucial to your long-term success and profitability. That’s why it’s so important to understand your cash conversion cycle (CCC), or the time it takes for your Amazon business to convert its inventory back into cash through sales.

An efficient cash conversion cycle allows you to reinvest profit, pay off investments, and maintain flexibility and agility in an ever-fluctuating market. An optimized CCC also allows you to sustain liquidity in terms of your cash flow, ensuring that you strike a balance between inventory levels and working capital available at a given moment.

So what makes up your cash conversion cycle (CCC)? Three key components determine how quickly your inventory investments can be returned to dollars.

This is the number of days it takes for a product to move from an inventory investment to being sold. It can also be conceptualized as how long your products sit on the shelf.

The average time it takes your Amazon wholesale business to collect payment for sales. This includes any delays in payouts from Amazon due to holds on your account or in case of returns.

The average time it takes for you to pay your suppliers after receiving inventory.

The cash conversion cycle formula is simple:

CCC = Inventory Days + Accounts Receivable Days - Accounts Payable Days.

Just like any other selling strategy on Amazon, your Amazon wholesale business will always be limited by cash flow. Fully optimizing your CCC will ensure that your cash flow is moving at maximum efficiency, but growing from there requires external support. That’s where funding designed to align with your CCC comes in.

Unlike other Amazon selling models, wholesale requires a much greater purchasing frequency, with turnovers in inventory in as quick as 6-8 weeks. This means that you need working capital available just as frequently to maximize your buying power and take advantage of new opportunities. However, it’s wise to avoid extended terms when it comes to funding, instead opting for a remittance plan that also aligns with your CCC and can be swiftly paid off. In an ideal financing situation, your Amazon wholesale business will be able to pay off one round of funding before taking on another to minimize expenses.

While there are a wide range of funding options available to wholesalers today, four methods dominate the Amazon selling strategy.

Business credit cards offer capital up to a certain threshold at the pace you need it for your Amazon wholesale business. For sellers just starting out and with little to no selling history, credit cards are an incredibly useful funding option thanks to their ease to obtain and the flexibility they offer. Additionally, many credit cards offer attractive features, like cash back.

However, credit cards always come with some sort of personal guarantee. This means that your personal credit and finances will become linked to your Amazon wholesale business–which is concerning if your business were to ever face financial difficulties. Credit cards can also become incredibly expensive quickly if they’re mismanaged or you accidentally miss a payment. Carrying a balance will incur large fees and interest that can cause a strain on your cash flow if you’re not smart.

Term loans include your traditional small business loans from banks, lump sum eCommerce funding, and outside investments. This type of funding provides a large sum of upfront capital that can be used for investments, including inventory or equipment.

With your speedy cash conversion cycle, lump sums get eaten up quickly by inventory purchases, and rapidly get absorbed into your regular cash flow. This means that they can only provide a temporary boost to your buying power. At the same time, these funding options are typically repaid over extended periods–meaning that you’ll be paying off capital long after it’s been spent, wracking up expenses.

While term loans can be a great fit for other Amazon selling strategies, such as private label sellers, they aren’t designed to optimize your wholesaler CCC.

Cash advance funding products will expedite your payouts to keep cash flow moving through your business and help with inventory purchases during lulls in your money’s movement.

While this type of working capital is conveniently accessible and theoretically money you’ve already made, think of this type of funding as borrowing from your future self. Although it may temporarily help streamline your cash flow, you risk causing your Amazon wholesale business to become dependent on advances. At the same time, many of these funding providers can be more expensive and carry a higher APR than other options.

Viably Wholesaler Accelerator is the first working capital product designed specifically for Amazon wholesalers. This solution is designed to increase your buying power and improve cash flow with pre-planned recurring fundings. This unique model allows you to continue buying inventory for your business in between payout cycles, boosting your sales. And, Viably Wholesaler Accelerator is a short-term funding solution–meaning that remittance is aligned with your cash conversion cycle to ensure repayment is swift, seamless, and stress-free.

The best Amazon wholesaler funding solutions will recognize your unique cash conversion cycle and identify ideal times to deploy recurring funding quickly, maximizing your ability to scale and take advantage of new opportunities. At the same time, they’ll design a short but sustainable remittance schedule that works with your Amazon business to avoid creating any financial pressure during busy seasons.

By choosing solutions, like Viably Wholesaler Accelerator, that take into account your CCC you can grow your business sustainably month over month to reach new and greater heights.

Originally published on March 19, 2024, updated February 25, 2025

This post is accurate as of the date of publication. Some features and information may have changed due to product updates or Amazon policy changes.

These Stories on Business

14321 Winter Breeze Drive

Suite 121 Midlothian, VA 23113

Call us: 800-757-6840

Copyright© 2007-2025 eComEngine, LLC. All Rights Reserved. eComEngine®, FeedbackFive®, RestockPro®, and SellerPulse® are trademarks or registered trademarks of eComEngine, LLC. Amazon's trademark is used under license from Amazon.com, Inc. or its affiliates.

No Comments Yet

Let us know what you think